Where are Real Estate Prices Going This Spring?

The answer to this question largely depends on rates and inventory levels. We're seeing rates down a bit in the aftermath of the bank failures, and it’s possible that a new round of financial uncertainty will be favorable for borrowers. We're all waiting to see what happens at tomorrow's Fed meeting.

Dr Lisa Sturtevant, our BrightMLS chief economist, says that low inventory will be the primary constraint on the housing market this spring. New listings are only trickling onto the market because the high rates are keeping potential sellers at bay with many of them are holding mortgages in the sweet 3% range. Inventory has been rising and in some markets active listings have doubled year over year but supply is still only half of 2019 levels. (2019 was the last time we saw a "normal" market.) Buyers will certainly have more choices going into the 2023 spring market but inventory is likely to remain low which will put a floor under prices keeping them stable or rising in most local markets this spring.

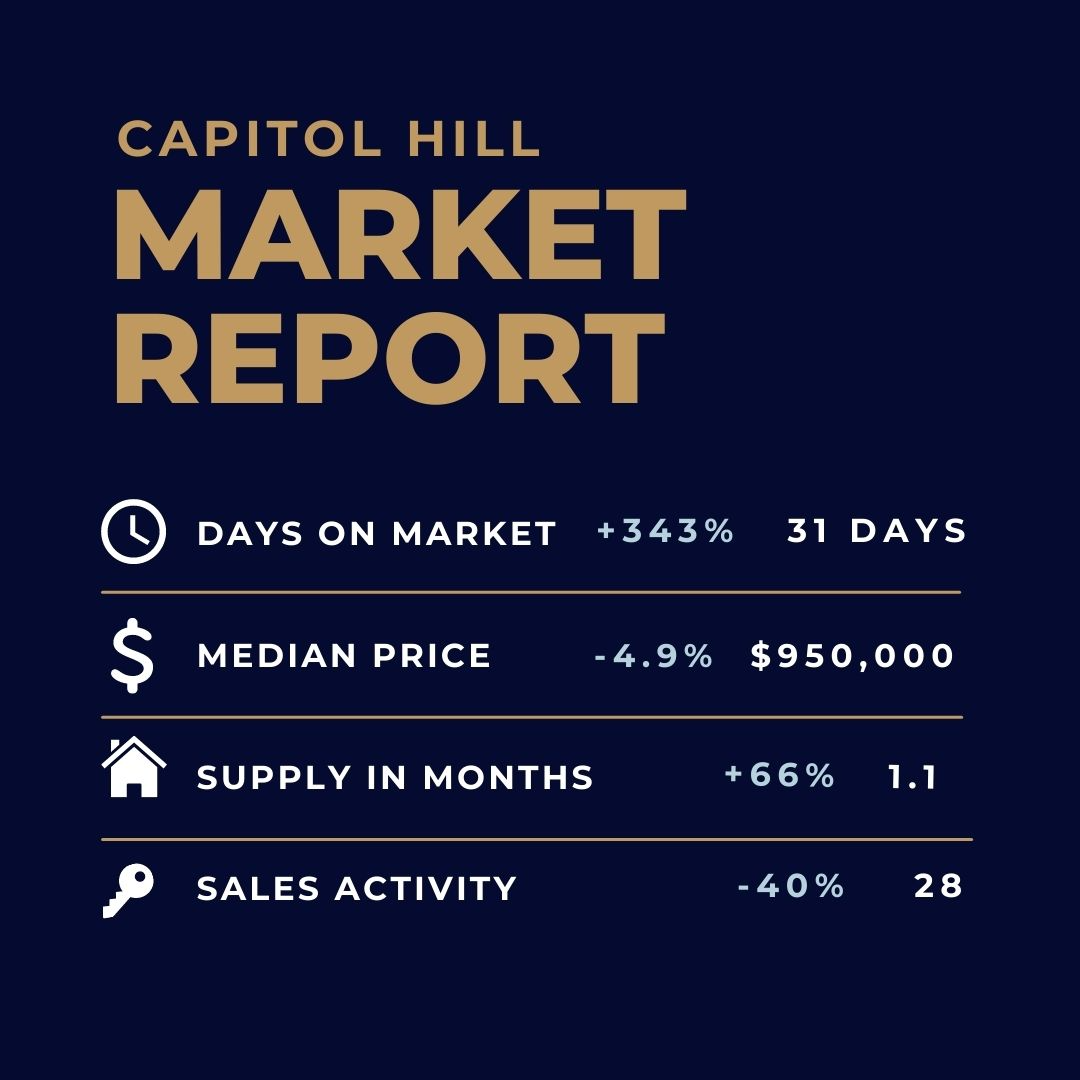

Here's a look at year over year numbers in 3 local DMV markets - Arlington, VA, Capitol Hill, DC and Silver Spring MD. In all three we see a month or less of inventory which is about as low as it gets. This means that if no new listings come onto the market, inventory would sell out in that time and that's exactly what's keeping a floor under home prices in the DC area. If rates continue to go down, which seems likely considering the bank failures, I expect to see more buyers enter the market which will create increased demand and push prices up into the spring and summer.

Even with the current market slow down we're still seeing the desirable listings go under contract very quickly. When rates dipped down just below 6% a few months ago we saw mortgage applications spike which means buyers are just waiting for an opportunity to jump. The slight pull back in prices that we're seeing in Capitol Hill at 4.9% and Arlington at 2.4% is marginal compared to the appreciation these areas saw over the last couple of years. Silver Spring with only a 3/4 month of inventory is seeing an almost 10% median price increase year over year. This is indicative of the low supply narrative and if inventory stays this low, it will continue to be a very competitive market for buyers there.

Overall I expect the spring market to see more inventory trickling on and if rates stay range bound in the mid to high 6's we'll probably continue to see reduced contract activity but prices stable and rising. If the rates get down into the 5% range all bets are off. Pent up seller and buyer demand will be unleashed and we could see the market speed up rapidly.

As always, reach out if I can be of service to you!

Erin

Categories

Recent Posts

GET MORE INFORMATION